how to lower property taxes in california

Ask the tax man what steps you need to take in order to appeal your current bill. Up to 25 cash back The San Francisco County Assessor placed a taxable value of 900000 on their home.

Op Ed Californians Should Wise Up About Our Stupid Tax Code Los Angeles Times

Simple tips to make your property tax bill as fair and manageable as possible are.

. Homeowners who are 62 years old or older are eligible to defer payment of their property taxes. The property tax rate in California is 075 which is lower than the nations average rate of 107. This means if a parent bought a property in the 1970s and has a tax basis that is.

Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county. If the tax rate is 1 they will owe 9000 in property tax. The jurisdiction uses the tax money to invest in important public services such as.

Ask the tax man what steps you need to take in order to appeal your current bill. Look for local and state exemptions and if all else fails file a tax appeal to lower your property. All property tax regulations are defined by Proposition 13 of the.

Contact your local tax office. Any additions renovations or improvements. Bonsai Tax can help.

In order to come up with your tax bill your tax office multiplies the tax rate by. Property taxes in California are calculated by multiplying the homes assessed value by the current property tax rate. Here are a few steps you can take to cut your property taxes.

By the time you are already paying a certain amount its. The easiest but most commonly overlooked action is the filing of a Prop. If you are self-employed a sure-fire way to pay less taxes in California is to reduce your business expenses.

If Bonnie and Clyde. To perform the oversight. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year.

What triggers property reassessment. In comparison to the. You must have a household income of less than 35500 per year and at least.

Here are a few steps you can take to cut your property taxes. Our software will scan your bankcredit card receipts. Your local tax collectors office sends you your property tax bill which is based on this assessment.

Steps to Appeal Your California Property Tax. Contact your local tax office. Assessed value is often.

First reassessment occurs if a change in control takes place resulting in a new owner who owns more than 50 percent of the entity. Applicants must file claims annually with the state. One of the most effective ways to acquire property ownership in California is through adverse possession which is the result of low property tax rates.

Avoid renovations or improvements. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California. 8 appeal by 915 of each tax year.

This video covers how property tax is calculated and how you can pay a lower overall property tax. Decline in Property Value Proposition 8 Since property taxes are calculated from the overall property value you should always try to have your property taxes lowered if the. It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level.

The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues.

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Understanding California S Property Taxes

Understanding California S Property Taxes

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Tax Calculator Estimator For Real Estate And Homes

New Prop 19 Property Tax Measure Can Save You Money Orange County Register

A Benefit Not A Burden City Journal

Property Taxes Yvonneyanghomes

Understanding California S Property Taxes

Why Is Texas Considered A Low Cost Of Living State When It Has Such Absurd Property Taxes Quora

California Property Tax Appeal How To Lower Property Taxes In California

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Are There Any States With No Property Tax In 2022 Free Investor Guide

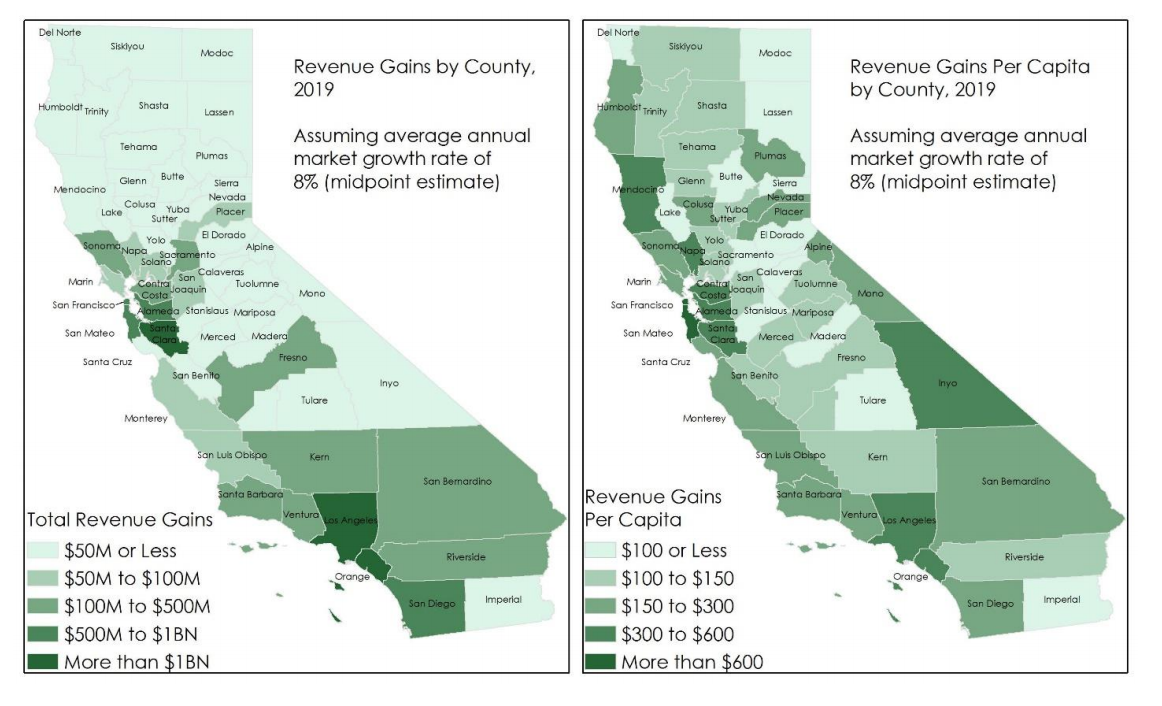

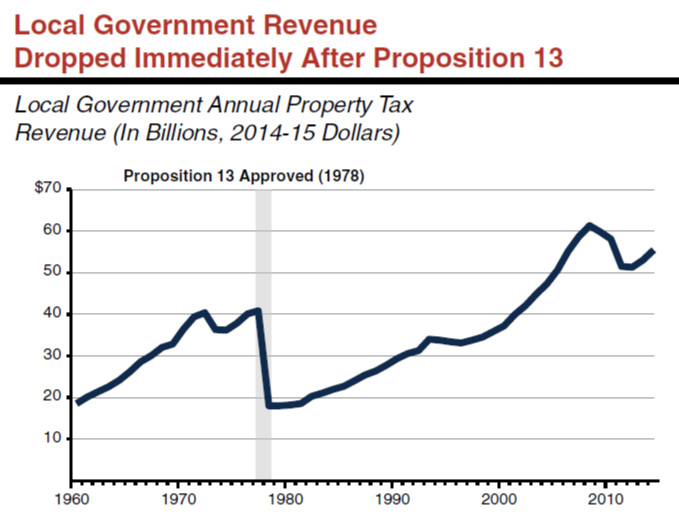

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

California Property Tax Appeal How To Lower Property Taxes In California

Property Taxes Are Twice As High In Poor Neighborhoods As Rich Ones The Washington Post

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts